Israel’s Sovereign Wealth Fund, known as the Citizens’ Fund, held assets worth approximately $2 billion at the end of 2024, The Press Service of Israel (TPS-IL) reported citing the Ministry of Finance. The fund, which manages state revenues from levies on natural resource profits, earned an 11.5% return on investments in 2024, bringing its average annual return since inception to 11.7%.

“This year tested the very purpose of the Israeli Citizens’ Fund as a fund that operates beyond short-term considerations and remains committed to its role and mission for the benefit of future generations. We maintained an investment policy focused on the long term, unaffected by local fluctuations, and guided by principles of stability, responsibility, and sustainable economic growth, even in difficult times,” said Finance Minister Bezalel Smotrich.

Established under the 2014 Israeli Citizens Fund Law and officially launched in June 2022, the fund invests in overseas financial assets. It aims to strengthen Israel’s economy through initiatives such as renewable energy development, research and development, and employment promotion in the Negev. The fund also provides an economic buffer during financial crises and mitigates risks associated with sudden revenue surges from natural resources.

In 2024, revenues deposited into the fund under the Natural Resources Profits Taxation Law totaled approximately $417 million. The previous year, the fund transferred about $33.6 million to the state budget for 2023-2024. Investment returns have fluctuated, with the fund earning 1.2% in 2022 ($10 million) and an exceptional 17.5% in 2023 ($149.5 million).

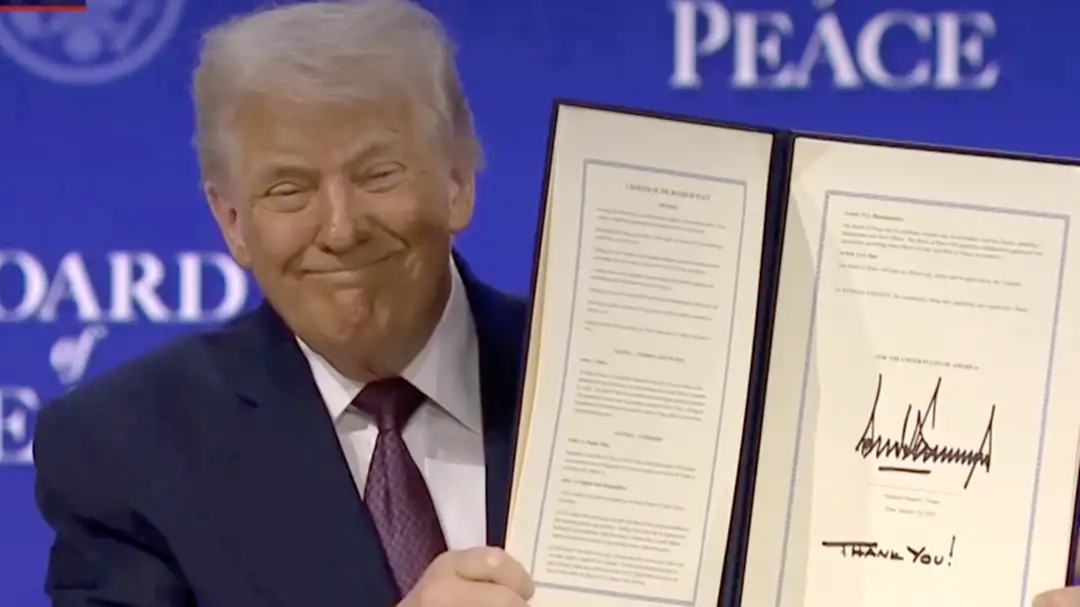

The Ministry of Finance attributed the fund’s strong 2024 performance partly to global market trends, including a surge in stock prices following Donald Trump’s U.S. presidential election victory. Stocks particularly US tech stocks — accounted for nearly 90% of the fund’s equity investments, delivering double-digit returns. Corporate bonds also outperformed government bonds, with short-term bonds yielding higher returns than long-term ones.

Managed by the Bank of Israel, the fund’s asset allocation shifted in 2024 to a more stock-heavy portfolio, increasing equity investments from 60% to 70%, while bonds were reduced from 40% to 30%. The decision reflected confidence in stock market performance, particularly in developed economies.